Many believe risk assessment is quite boring subject and has nothing to do with reality on board ships.

Some also believe it is all about documenting risk assessment form proving that risk assessment is carried out. But in realty, risk assessment is not only about creating huge amount of paper work. It is rather about identifying sensible measures to control the risks in your workplace.

Risk assessment is not a new thing. Its only that shipping industry is taking it more seriously now.

A teacher teaches her students to cross a road. Use a zebra crossing, first see towards your right, and then left…and so on. This is what risk assessment is all about.

So how risk assessment applies to maritime industry and how we can manage these risks to have safer maritime industry.

Let us discuss.

Risk Assessment as decision making tool

Everything in life has some risk. What you have to actually learn to do is how to navigate it.

This quote from Reid Hoffman outlines what risk assessment is all about. On board a ship, there are many hazards and these pose even more risks. Risk assessment acts as a tool to manage these risks.

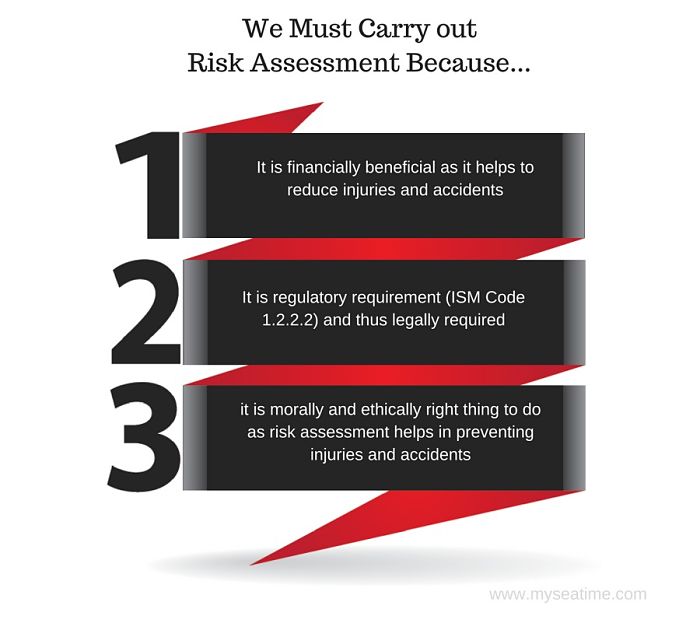

There are three main reasons as to why it is important to carry out risk assessment.

1) because it financially beneficial as it helps to reduce the risk and thus accidents

2) because it is regulatory requirement and thus legally required to conduct risk assessment. Paragraph 1.2.2.2 of the ISM Code states,

“Safety management objectives of the company should …. assess all identified risks to its ships, personnel and the environment and establish appropriate safeguards”. This 2010 amendment to ISM code has included the risk assessment explicitly.

3) because it is morally and ethically right thing to do as risk assessment helps in preventing injuries and accidents.

Risk Assessment is a decision making tool. The use of risk management techniques started from the Insurance industry. When the industry plans to insure a particular object, especially a new one, they need to conduct a Risk Assessment.

This helped them to decide whether it is OK for the business to go ahead with it. The hazards and risks involved decides the amount of premium.

Even with maritime scenario, the whole purpose of the risk assessment is to answer this question. “Will it be safe to go ahead with an operation ?”

It was the year 1997 that marked a major step towards risk based approach in the maritime field. This was the time when the Maritime safety committee (MSC) and the Marine Environmental Protection Committee (MEPC) of the IMO adopted the Interim Guidelines for the Application of Formal Safety Assessment (FSA) to the IMO Rule-Making Process.

Since then risk assessment has only been evolving and it has now become a decision making tool at the ground level too.

How to conduct risk assessment

Various publications provide various guidelines regarding the steps for risk assessments. The most widely accepted in shipping industry is the 5-step process.

1. Identification of Hazards

First step is to identify all the hazards. But to identify hazards we must understand what a hazard is ? We sometimes get confused between hazard and risk. These examples can simplify this.

- A ladder is a HAZARD which creates a RISK of falling

- Grease on deck is a HAZARD, slipping is a RISK

- A hammer is HAZARD, injuring your thumb is RISK

- Lack of oxygen is a HAZARD, Asphyxiation is a RISK

- Oily rags is a HAZARD which creates a RISK of fire

The use of the term ‘hazard’ originated in the nuclear and chemical industries for which a wide range of different types of ‘hazards’ are present all the time (e.g. nuclear material, flammable gases, toxic chemicals etc.)

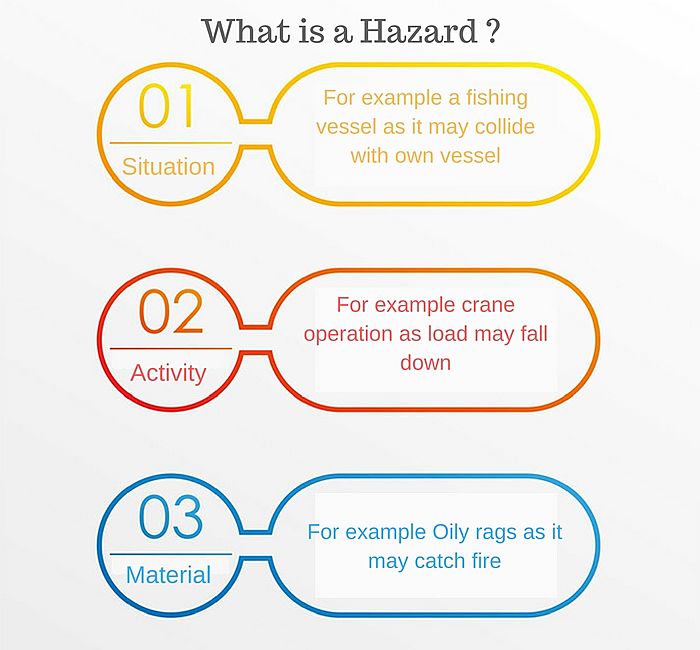

A hazard is a substance, situation or practice that has the potential to cause harm. Risk is the Probability of the harm occurring (combined with the consequence of the harm).

The hazard may be a physical situation such as fishing vessel because it may collide with own vessel. It may be an activity like crane operations because the load might drop. It may even be material such as oily rag because it might catch fire.

In practice, the term “hazard” is often used for the combination of a physical situation with particular circumstances that might lead to harm. For example, a collision with fishing vessel, a dropped load or an oily rag fire.

Consider you are in a zoo. What is more RISKY, a tiger in a cage or the same tiger outside the cage walking freely. Here the tiger is a HAZARD, whether inside or outside the cage, but the probability of causing harm, and hence the risk is more when the tiger is outside the cage. Thus, the risk can change for the same hazard under different circumstances.

It is difficult to declare completeness of a hazards identification process, and hence hazard identification should be periodically reviewed.

Risk assessment in general and Hazard identification in particular is a team work.

2. Risk Estimation

Safety is related to the degree of absence of risk. Because no activity is free of risk, an activity is considered safe when the level of risk is within acceptable limits.

But how do we know if the risk is acceptable or not ? We should be able to calculate the risk and we should know how much risk is acceptable ? In short we should know how to calculate or estimate risk.

IMO defines risk as ‘the combination of the frequency and the severity of the consequence’ (MSC Circ 1023/MEPC Circ 392). Here the frequency is ‘the number of occurrences per unit time (e.g. per year)’ and consequence is ‘the outcome of an accident’.

In simple words, risk has two components:

- How likely is this to happen? – likelihood of occurrence (frequency)

- How bad would it be if this did happen? – severity of the consequences

We would need both the above components for estimating the Risk.

A reliable equipment would mean that there are lesser chances of it breaking down. That is frequency (likelihood of occurrence) is low.

But to estimate the risk we also need to consider the severity of consequences if the equipment fails.

We need to combine both these factor to get a fair estimation of risk involved in using this equipment.

Traveling by a plane has far more severe consequences than traveling by road. But the frequency and finally the risk as per statistics is far less. But it is a matter of fact that the perception of risk is higher than the actual risk in case of travel by a plane. This is perception of risk vs actual risk.

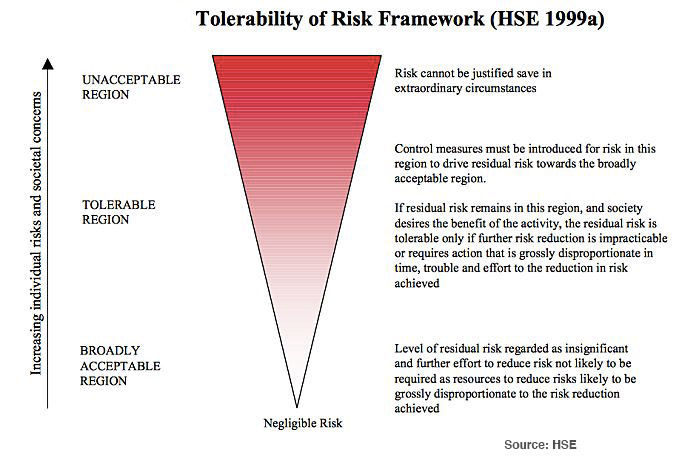

Even though we think the risk for traveling by air is higher than traveling by road, but still we travel by air. This is the basis of Risk assessment and is called ‘As low as Reasonably Practicable’ or ALARP.

If we go by road, there is some cost, time and effort involved. These would be disproportionate to the benefits of risk reduction that we would achieve.

So in deciding the practicability of how much risk reduction is enough, we compare a hazard with three things.

- Cost

- time

- effort involved.

It is possible that we avoid traveling by air but it is not practicable (Possibility vs Practicability). The fundamental principle of risk management acknowledges that the risk cannot always be eliminated.

But it is possible to reduce them to a level that is ALARP. This is the level where the risk is tolerable as reasonable practicable risk reduction measures would be in place.

So we can estimate the risk by combining frequency and severity of consequences.

This combination of Frequency and Severity of Consequence can be done in many ways.

Each company may have different method which you will get in company’s safety management manuals.

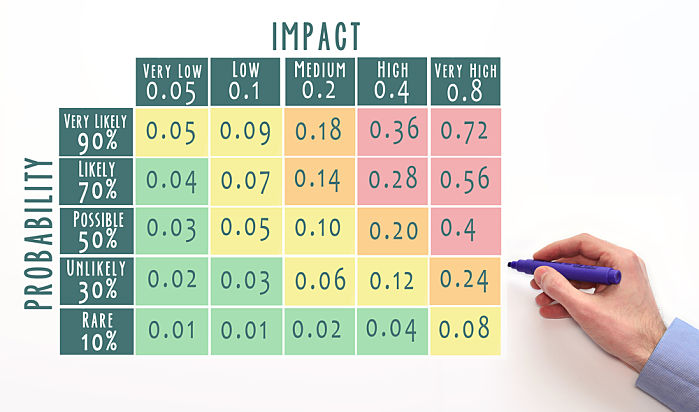

A company may decide to prepare a Risk Estimator matrix with Likelihood and consequences on the y and x –axis respectively.

The likelihood and consequence is to be estimated with existing controls in place and a resultant risk calculated from the matrix.

The company SMS should identify the level of risk for which additional controls will be required before the job is started.

For example the company might decide that additional controls are required if the risk level is Moderate or above as per below example of risk matrix.

Another methodology is to give values to Frequency and Consequence and then calculate the risk by Multiplying the two values i.e. Risk = Frequency x Consequence.

Remember, the likelihood and consequence is to be estimated with existing controls in place. The company SMS has to identify the Risk value for which additional controls are required.

Few company SMSs recognizes that the risk depends more on consequence than the frequency. In this case they calculate risk as below:

Risk = Frequency x Consequence squared (F x C^2)

What method we need to follow to calculate the risk would depend upon your company’s SMS.

3. Control the serious risks

This is the step in which we evaluate options for controlling the estimated risks.

The principle of controlling the risk is simple. We should aim to remove the risk. But even if we cannot remove it completely, we must reduce it to as low as reasonably practicable (ALARP).

There are four way we can handle the identified risk.

i) Avoid the risk altogether

Not a likely option if the work or operation has to be completed. But this may be necessary at times for safety.

For example in emergency if we have to abandon the ship in rough weather, we cannot avoid it though it would be risky.

ii) Reduce the potential impact of the risk

This involves reducing either the likelihood (frequency) of a loss occurring or the consequence (severity) or both. This can be achieved by taking extra precautions.

When we take extra precautions, it is important to evaluate what is decreasing. Likelihood, consequence or both.

Usually it is the likelihood that will decrease, as decreasing consequence at times is not practical.

But there can be times when the consequence alone or both will reduce. An example can be working aloft on a mast. Using a safety harness will reduce the likelihood of falling down because if at all the person falls, the consequence will be same. The consequence can be reduced if we rig a net below the mast.

iii) Transfer the risk to another party

Not a common option for seafarers but can involve the use of specialists or technicians. For example a contractual transfer of risk to a third party by hiring a thir party to do the work.

iv) Retain the risk with no planning

Off course it is not the best option to retain the risk and proceed with the work.

4) Identify benefits, implement action and establish responsibility

Now that we have estimated and identified the steps to manage the risk, it is time to implement these actions. We also need to establish responsibilities for each identified actions to reduce risk.

5) Monitor the risks

During the course of work, many factors can change. It is important that we continually monitor, review, evaluate and modify the first three steps in the process.

We also need to document a feedback at the end of job. The feedback should mention if the control measures taken for the job were enough. This feedback then can be used next time similar job is planned.

Type of Risk assessments

Formal and Informal Risk assessments

Formal risk assessment is done as a team. It starts with a meeting for hazard identification, completing all steps and the process is usually logged down in a specific form.

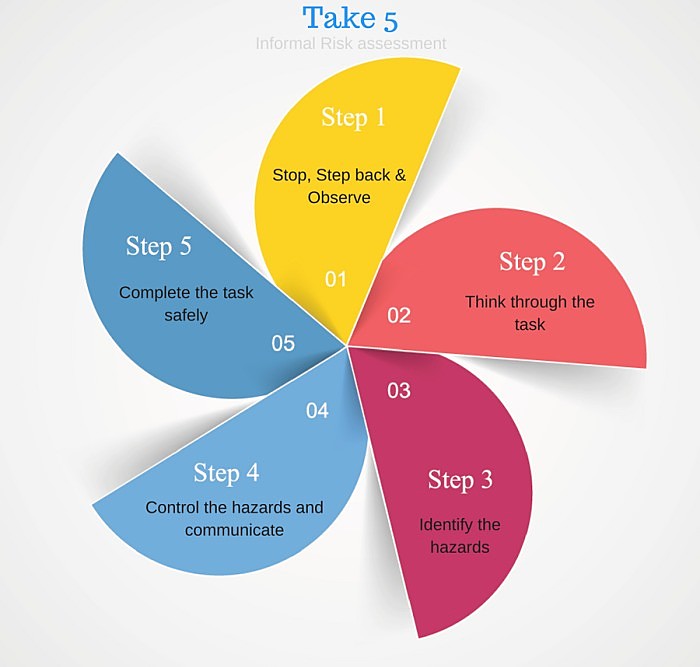

An informal risk assessment complements the formal process and is not a replacement for formal risk assessment. It is usually done on an individual basis for his daily work activities.

For example “Take 5” and SLAM (Stop, Look, Assess and Manage) techniques remind us to stop work if our health and safety is at risk.

Qualitative Semi-Quantitative and Quantitative Risk Assessments (QRA)

Qualitative risk assessment techniques uses simple methods to evaluate risk. This does not need a high level of skill and can be measured in non-numerical ways. An example is the risk matrix generally used on board ships.

Quantitative risk assessment uses complex methods like special software which precisely calculates the numerical value of risk.

This requires high skill levels and knowledge of software or other applications. The classification societies have developed software for the use of highly hazardous operations.

Semi-quantitative risk assessment lies somewhere between the above extremes. It uses numerical values to calculate risk but does not use special techniques like a software or similar application.

For example if both the probability and severity can be quantified, the risk is simply the product.

Risk = Probability x Severity.

On board ships we generally use qualitative techniques.

Conclusion

Risk assessment is no more an additional voluntary safety tool. Shipping industry is becoming more and more serious to it. Following any incident, the first question that is asked is “if the risk assessment was carried out or not” ?

The effectiveness of risk assessment in reducing the risks depend upon the seriousness with which it is carried out.

Share this:

About Capt Bhupender Singh Banga

Capt. Bhupender S. Banga has sailed for over 15 years mainly on crude oil, product and chemical tankers. He holds Post Graduate Diploma in Shipping Management. He quit sailing in 2013 and is presently working as a Superintendent in Learning and Development team of a leading shipping company from Denmark.

Search Blog

22 Comments

Certain Items at sea require strict legislation a vessel operator can carry out a risk assessment of the area in questions and supply this documentation to the insurance companies. this was validated the insurance regardless of product requirements.

Thank you sir.It was very useful and it also d

Thank you so much for such a helpful post... you are the first whom i found to be explaining the blog writing method with ease... god bless u.

Wonderful website. A lot of useful info here. I am sending it to a few friends ans also sharing in delicious. And obviously, thanks for your sweat! IT Support Dallas

Simplified yet explanatory blog. Many thanks for simplifying this topic so that everybody can understand RA. Very helpful for examination purpose also.

Respected sir, how do we calculate frequency or probability of occurence?

Please advise how to prepare annual mooring review risk assessment in accordance with MEG 4. Thank you

Too much "experienced" indians over there. Kick out them from shipping

Very helpful and nice sharing, thank you and keep it up!

Amazing article sir....

Thank you for this very useful blog. Risk Assessment is important for safety onboard.

very interesting...

i'm very glad full to you because you have to describe about what is risk assessment and why is useful on board . this is very knowledgeable thank you so much for this Blog https://www.benchmatrix.com/risk-rating-engine/

Nice post ! Thanks for the share in Risk Management.

God bless you Capt. Risk assessment has become a knowledge I acquire through your knowledge. Thank u

Pretty clear and straight forward. Thanks Captain Bhupender Singh Banga. As I was looking for more detailed information related to our present discussion, I bumped into one of your blog instead. This is quite informative, concise and straight forward. A pleasure to work with you.

My ex-husband and I had always managed to stay friendly after our divorce in February 2017. But I always wanted to get back together with him, All it took was a visit to this spell casters website last December, because my dream was to start a new year with my husband, and live happily with him.. This spell caster requested a specific love spell for me and my husband, and I accepted it. And this powerful spell caster began to work his magic. And 48 hours after this spell caster worked for me, my husband called me back for us to be together again, and he was remorseful for all his wrong deeds. My spell is working because guess what: My “husband” is back and we are making preparations on how to go to court and withdraw our divorce papers ASAP. This is nothing short of a miracle. Thank you Dr Emu for your powerful spells. Words are not enough. Email emutemple@gmail.com Phone/WhatsApp +2347012841542.

I want to genuinely thank Dr Ayoola for making my dream come through. I was on the internet when I saw people posting and talking about Dr Ayoola. On How he has help them in winning lottery. My name is Gerald Muswagon this is my story on how I win $10 million After reading the article about Dr Ayoola I contacted him I told him to help me win lottery he respond to me by saying he will help me after working with him he assured me that I will win. Which I believe. After working with Dr Ayoola he gave me a number and ask me to go and play it which I did today I’m here shearing a testimony about this same man Dr Ayoola help me to win $10 million dollars all thanks to you Dr I will keep taking about your good because you are a man of your word I hope people that really need this will come across it for you to help them as well. If you want to win big in lottery contact Dr Ayoola today and be rest assured of winning contact him via email drayoolasolutionhome@gmail. com or https://www.facebook.com/Dr-Ayoola-105640401516053/ text or call +14809032128

Leave Comment

More things to do on myseatime

MySeaTime Blogs

Learn the difficult concepts of sailing described in a easy and story-telling way. These detailed and well researched articles provides value reading for all ranks.

Seafarers Question Answers

Ask or answer a question on this forum. Knowledge dies if it remains in our head. Share your knowledge by writing answers to the question

MySeaTime Podcast

This podcast on the maritime matters will provide value to the listeners. Short, crisp and full of value. Stay tuned for this section.

Thanks a lot sir.You made it so simple.Understanding of RA especially in junior ranks is so complex but as you grow this becomes very important aspect and you can't ignore it.Thanks again.

Thank you Abhishek

Glad you found it useful Abhishek. Yes you are absolutely right about the importance of RA.

the information was really useful. thank you very much sir.